Financial Literacy and Entrepreneurship in the Digital Era: BINUS x CHUBB

The current digital era has significantly transformed the finance and entrepreneurship sectors, expanding access to financial tools and opportunities through fintech, e-commerce, and digital services. Despite this, financial literacy remains a key to success in this rapidly changing environment.

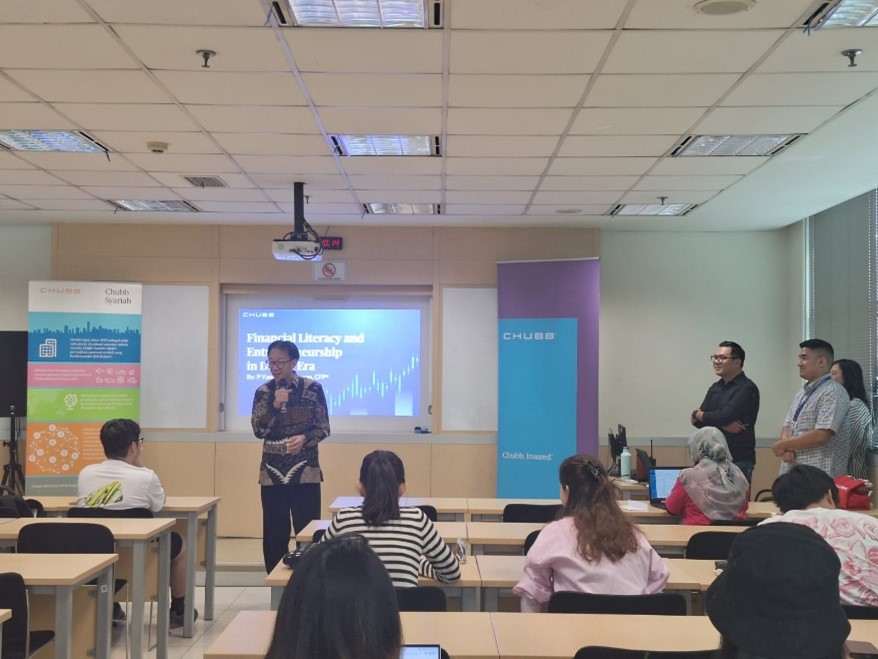

This seminar, organized by CIDER (Center for Innovation, Design, and Entrepreneurship Research) and GEE (Global Employability and Entrepreneurship), with participation from BINUS University International students, aimed to enhance the participants’ financial literacy and provide entrepreneurial strategies, emphasizing the importance of digital financial tools and the creation of sustainable, technology-driven businesses. The participants could gain insights to improve their understanding of financial literacy within the digital economy while exploring the opportunities and challenges of entrepreneurship in this era. The discussion also covered the digital tools and resources available to aspiring entrepreneurs, focusing on how to leverage them for business growth. Additionally, the seminar provided practical strategies for managing both personal and business finances using digital platforms.

The key topics discussed included the importance of financial literacy in the digital era, with a focus on managing personal and business finances, savings, investing, and utilizing digital financial tools. The seminar also explored entrepreneurial strategies in the digital age, emphasizing how to start and scale a business using digital platforms. Furthermore, it reviewed fintech solutions, highlighting the latest financial technology tools for efficient financial management, and addressed important aspects of cybersecurity and digital payments to ensure secure financial transactions in the digital environment.

With the participation of BINUS and CIDER, this seminar aimed to foster collaboration and knowledge sharing, by equipping the participants with the skills needed to navigate the complexities of the digital economy. By the end of the event, the attendees were expected to have a better understanding of digital financial tools and management strategies, empowering them to face the existing challenges and seize emerging opportunities in an increasingly interconnected business world.