The Future of Fintech in Southeast Asia Session with DANA

On 6 May 2021, we organised a public lecture session titled The Future of Fintech in Southeast Asia. The guest speaker in this session was Vince Iswara, CEO and co-founder of DANA, one of the leading digital wallet providers in Indonesia. This event was moderated by Shinta Amalina H. Havidz, lecturer specialist S3 of Finance Program. In the middle of his hectic schedule, we were grateful that Pak Vince was willing to share his views on the future of fintech in Southeast Asia.

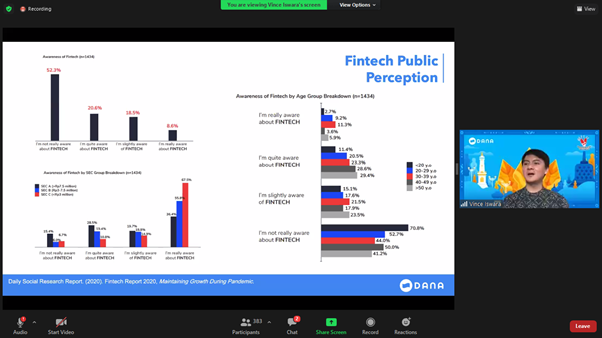

At the beginning of the session, Pak Vince briefly introduced DANA, including its vision and mission. He then continued on by pointing out the large opportunities of fintech future development in Southeast Asia. Compared to the benchmark (US/ UK), there are a lot of rooms for fintech to grow in Southeast Asia, for example in the areas of banking, payments, lending, insurance, and investment. Specifically, in Indonesia, there are a lot of opportunities as well, as currently there are more than 92 million unbanked population, 35.5% digital financial literacy rate, and 31.26% digital financial service users in Indonesia. It is also predicted that even SME (small and medium enterprises) merchants will switch from cash to digital in a not-too-distant future. Towards the end of the presentation, Pak Vince shared some data about public perception on fintech and consumer behaviour during pandemic, as well as mapping of regulated fintech business models in Indonesia.

We hope that this session would be beneficial for all participants who came in the event in understanding the fintech industry and its future prospect, particularly in Southeast Asia.

Opening remarks from Pak Gatot Soepriyanto, PhD. (Dean of Faculty of Economics and Communication)

Our speaker, Pak Vince Iswara