Impact of Covid-19 to Accounting: Interim Reports, Disclosures and Auditing

This sixth installment of the series will discuss the impact of Covid-19 to interim reports, disclosures and auditing. This article and other articles in the series summarize the impact based on several credible sources, i.e. the Big Four accounting firms, professional accountancy organization and IFAC (International Federation of Accountants). For further and detailed discussion, please refer to the original documents as cited in the sources at the end of this article for further reading, of which the links to access the full report are provided.

1. Interim reports

As detailed in IAS 34, interim reports are financial reports issued by entities for a period less than a full financial year, for example quarterly or half-yearly reports. During normal circumstances, around this time companies should have submitted their 2020 Q1 report (January-March), however due to Covid-19 some of them might even still not be able to submit their 2019 annual report. Therefore, some governments relaxed the submission deadline by giving companies more time to do so, for example in Indonesia, where the deadline is extended from end of March to end of May 2020. When preparing interim reports during this pandemic situation, it is likely that companies will experience greater use of accounting estimates and additional disclosures, as discussed below.

2. Disclosures

Entities will likely increase their extent of disclosures in relation to significant estimation uncertainty, to inform the users of financial statements of the likely financial impact that might happen in the future as a result of Covid-19. Entities also need to disclose the financial risks they are exposed to, for example credit, liquidity, currency, and other price risks, and how they are mitigating these risks. Aside from financial statement disclosures, entities could also provide additional disclosures in management discussion and analysis section outside of financial statement, to update the users on current situation and how entities are managing their business.

3. Auditing

Since Covid-19 affects accounting, it will also affect auditing process. Some of the likely impacts are:

- Risk assessment

Audit risk assessment procedures are performed to obtain understanding of the entity’s environment and internal control, so auditors can identify and assess the risk of material misstatement of the financial statements. Covid-19 could increase the risk of material misstatement, so auditors should be more careful about this and perform the necessary adjustments to their audit approach.

- Audit evidence

Collecting audit evidence could be a significant challenge during physical and social distancing or even lockdown environment. As a result, auditors need to change audit approach and think creatively to find other alternative procedures that can utilize the advancement of technology nowadays.

- Going concern assessment

As discussed in the first installment of the series, going concern basis is one of the highly affected areas arising from Covid-19. Auditor must assess whether the entity’s ability to continue as a going concern has been compromised and adjust the auditor’s opinion accordingly.

- Adequacy of management disclosure

As stated in the previous section on disclosures, it is likely that more disclosures are required, both within and outside of the financial statements. As a consequence, auditors must also assess whether such disclosures are adequate.

- Impact on auditor’s report

Other than the going concern issue, auditors should also consider the impact on their opinion resulting from, for example, inability to gather sufficient evidence.

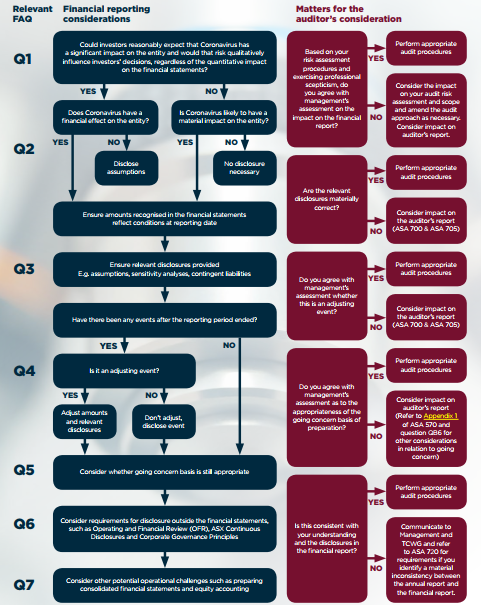

The following guideline lists some financial reporting and auditor’s considerations that can be used by both entities and auditors to help them in preparing financial and audit reports, respectively.

Source: AASB & AUASB (2020), p. 5.

Sources:

AASB & AUASB 2020, The Impact of Coronavirus on Financial Reporting and the Auditor’s Considerations: AASB-AUASB Joint FAQ, March

Accountancy Europe 2020, Coronavirus Crisis: Implications on Reporting and Auditing, 20 March

EY 2020, Applying IFRS: IFRS Accounting Considerations of the Coronavirus Outbreak, February

Gould, S. & Arnold, C. 2020, The Financial Reporting Implications of COVID- 19, 13 April, IFAC Knowledge Gateway

IFRS Foundation, IAS 34 Interim Financial Reporting

Joo, I.K 2020, Impact of COVID-19 Pandemic on Reporting and Assurance, keynote address for the ICAI Covid-19 global webinar, 13 April

KPMG 2020, Quick Guide on COVID-19, https://home.kpmg/xx/en/home/insights/2020/03/covid-19-financial-reporting-resource-centre.html

PwC 2020, In Depth: A Look at Current Financial Reporting Issues – Accounting Implications of the Effects of Coronavirus, 17 March

(AL)