THE FUTURE FINANCE FUNCTION: DIGITAL FINANCE

Digital finance is the future of finance. This is the recurring theme that is coming out of recently published reports by several organizations. A 2019 report issued by the Institute of Chartered Accountants in England and Wales (ICAEW) in collaboration with Institute of Singapore Chartered Accountants (ISCA) reported the perspective of UK and ASEAN with regards to digital transformation in finance function. They conducted interviews with CEOs, CFOs and other people who are involved with the digital finance transformation from UK and representative of ASEAN countries (Singapore, Malaysia, Vietnam, Indonesia and Cambodia). Based on the interviews, they found three emerging themes that support such transformation:

- Shifting from traditional accounting and finance processes into business partnering to provide financial insight to the organization

- The need for strong leadership to encourage people to change

- Continuous improvement (iterative) approach to the transformation, rather than the ‘big bang’ approach

In another publication issued last year by Oracle Cloud, the Association of International Certified Professional Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA), they reported the key traits of digital finance leaders after conducting surveys to more than 700 senior finance leaders globally. The report also discussed the evolution of finance function across three dimensions: digital impact, digital operating model, and industry leadership. Among the key findings reported are that organizations who are “Digital Finance Leaders”, i.e. have advanced finance teams, are more likely to be successful. In addition, organizations need to also accelerate finance transformation to deliver digital finance leadership in these three essential dimensions: operational excellence, digital intelligence, and business influence. They also provided a framework for enterprise digital-age readiness as displayed below:

Next, a 2020 report by Deloitte reviews the workforce changes in relation to digital finance world that organizations must be aware of. Some of them are:

- Humans and machines – as we all know, technology will replace some of humans’ jobs, but that is not the main issue here. The emphasis is on the changing skill sets required from those human jobs that remain and how to manage such changes

- Build, borrow, buy – organizations could fulfil their workforce requirements by combinations of building their existing workforce, borrowing resources from other parts of the business, and buying them

- Drive and thrive – designate the finance leader and create mentoring programs are among the initiatives suggested to be taken by organizations

- Here and there – be prepared for the change in the nature of workforce that will be spread across different countries and not full-timers

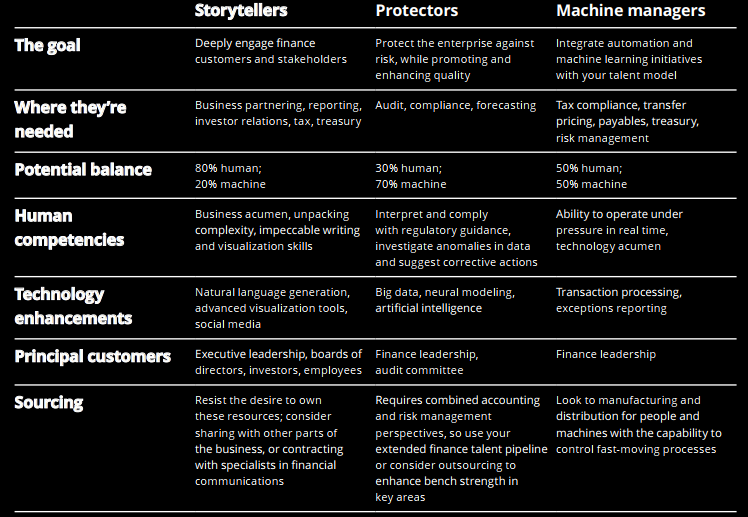

- New and different finance function – in the future, there will be combinations of people and machines to fill in the finance role, as portrayed below:

Thus, the shift to a digital finance requires significant effort to be put by organizations. Not only that, organizations must also consider the workforce element to support them in the digital finance transformation. This is not an easy task, some organizations might not be ready for it, some are classified as laggards, while some are already becoming the leaders. At the end of the day, organizations should go through and embrace this challenging journey and evolve, otherwise their existence will be at risk.

Source:

Deloitte. 2020. The Finance Workforce in a Digital World

ICAEW and ISCA. 2019. Digital Transformation in Finance Function: ASEAN & UK Perspective

Oracle Cloud, AICPA & CIMA. 2019. Agile Finance Unleashed: The Key Traits of Digital Finance Leaders

(AL)